A portfolio approach for urban investments

By Francesca Medda

The projects that are financed in an urban environment depend on a variety of factors. With the portfolio approach cities can determine which projects benefit them most in terms of profits and social benefits and can choose them accordingly.

Municipal finance and innovative approach

The present global tightening of credit restricts local governments and private firms in their capacity to leverage debt in order to finance investments in urban development, especially when they advocate far- reaching sustainable solutions. High cost considerations and protracted delivery timetables continue to deter decision-makers and private investors from adopting innovative financing solutions as an alternative for investing in urban projects. However, city authorities and their leaders still give the private sector carte blanche, in some cases to invest in such piecemeal projects as, for example, multiplex shopping malls, Wifi upgrades in high rise apartments and waterfront features. Nevertheless, a new urban paradigm, which embeds economic, environmental and social aspects within innovative financial mechanisms, is emerging. Central to this new paradigm are creativity, knowledge and access to information as fundamental drivers of the new urban finance, where ‘creativity’ in our city context is the process of value creation (Porter and Kramer, 2011). And with knowledge and access, the goal is to ensure shared and inclusive prosperity, and to increase resilience to external shocks brought about by financial crises as well as natural catastrophes.

Interdependency of urban assets

The central idea of the urban portfolio approach (Medda et al., 2014) is to create access to finance for cities by combining several urban investments that are interdependent with one another. The interdependency is the multiplier of the investment value because we leverage the concept that a competitive and successful city is a city that not only has efficient infrastructure and business, but also provides effective social and environmental infrastructure such as health care and education. Therefore, we create an urban investment portfolio not merely by selecting projects for their financial returns; but rather, economic, environmental and social impacts are equally considered in the investment selection. In this way the optimal portfolio is defined by the joint maximisation of the greatest yields for both the public and private sector. Thus, the innovation of the urban portfolio is the idea of investing in differentiated, yet integrated, investments. A diverse portfolio allows for risky as well as less risky investments, giving the private sector high financial returns while also addressing wider city/social needs.

Private sector participation in urban investment is likely to increase if the portfolio offers a wide range of urban assets in which to invest, including energy efficiency, urban development and urban regeneration. By combining different types of projects and fostering synergy between the investments, a diversified portfolio with good financial returns on some projects will compensate for the poor financial returns of other projects which nevertheless achieve good non-financial impacts. Private sector participation is expected to increase if the investment portfolio ranges across sectors and objectives to include integrated sustainable urban investments and is also attractive to pension funds, commercial banks and regional development institutions. For instance, a cross-subsidy process between projects would allow schools to be built, importantly, without the need for grants or state aid; these investments give low financial returns but they also have high non-financial impacts for a city.

Managing localisation

Many cities, particularly in developing and transition economies, suffer in the absence of systematic asset management. For this reason cities often cannot rely on the strategic capacity of local self-governments (referred to as localisation) to take responsibility for finance and delivery of goods and services. Nevertheless, as Kaganova and Kopanyi (2014) have observed, these city functions “have the most direct effects on the lives of local citizens.” From this perspective, and by factoring interdependency into our definition of a portfolio approach for urban investment, we can re-envision city financial models by linking some of the urban assets through various urban investments (an example is the coordination program of land ownership, businesses and infrastructure development in Kathmandu, Nepal).

Portfolio management

The development of the new portfolio for urban investments is designed to give stakeholders and decision makers a practical tool to structure and combine different typologies of projects (Medda et al., 2014). We can summarise the main reasons for implementing this approach, which are to:

- Combine different types of projects, thereby fostering synergy between investments and obtaining a diversified portfolio, where the good financial returns of some projects can compensate for (cross-subsidise) the ‘poor’ financial returns of other projects which nevertheless achieve good non-financial impacts (socio-economic and environmental benefits).

- Increase private sector participation by structuring a portfolio offering feasible and attractive opportunities for investment in different types of urban assets, including energy efficiency, urban development and urban regeneration.

To structure the portfolio of projects effectively, it is necessary to estimate the amount of risk, as a lower level of risk exposure is attractive to the private sector. We have observed that urban projects are often susceptible to high levels of political/government risk, particularly in regard to land purchase, planning and building permits, possibly leading to protracted delays. In the evaluation of the portfolio both political and governmental risk are captured directly.

We have mentioned the administrative and political agencies which are the overseers of projects; these agents are fundamental to the effective implementation, successful completion and transparent monitoring and assessment of urban investments.

Urban Portfolio: a new mechanism for municipal finance

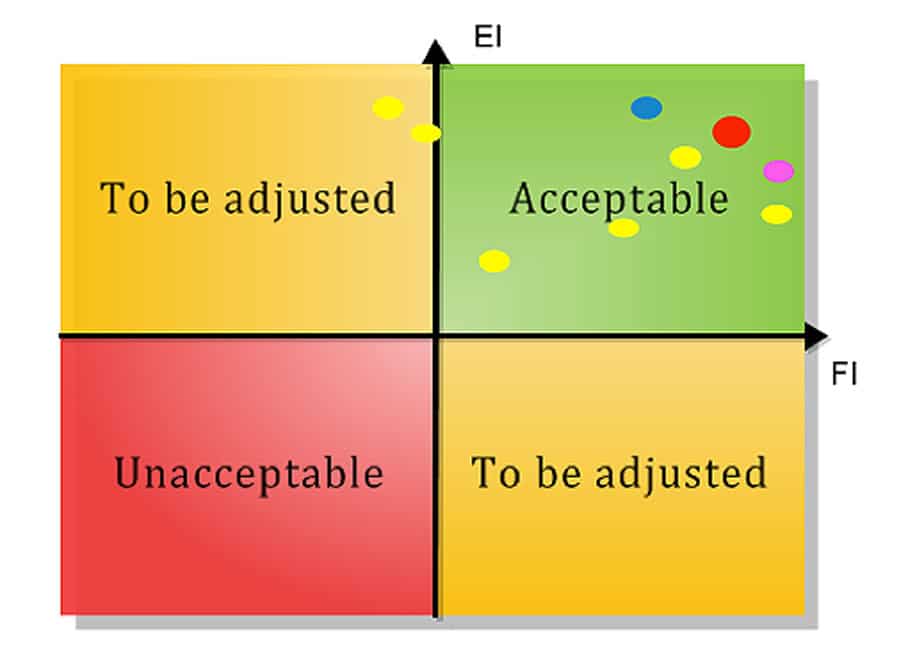

The graph below depicts an example of the portfolio approach for urban investments. Non-Financial Impacts are measured on the vertical axis “EI”, and Financial Impacts are shown as “FI” on the horizontal axis. All yellow dots indicate single projects (6 in total), and the other dots (blue, red and pink) indicate some portfolio combinations of the projects (in total 52 combined portfolios of the 6 projects).

The portfolio that our city should select is represented by the red dot. The visualisation of projects and their alternative portfolio combinations is an important feature of the portfolio approach. In fact, the user of the portfolio software platform can easily evaluate different portfolio options (blue, pink and red dots). For instance, the user can choose the blue or the pink portfolio in accordance with a preference for either Non-Financial or Financial impacts. If the user values financial performance above non-financial impacts then the portfolio with the highest financial impact (pink dot on the graph) will be selected. Moreover, if new projects are added to the portfolio over time, the user will be able to verify whether or not they improve the overall performance of the portfolio.

The portfolio investment approach demonstrates that not only is it possible to develop a practical decision-support system to assist stakeholders in assessing the performance of individual projects, but it also shows how to combine projects within an integrated portfolio. This is particularly important in developing countries, where increasing urbanisation is escalating poverty, social exclusion and declining the quality of services. This type of innovative financial tool for city investments can spur further financial innovations and facilitate connections and new ownership among citizens. As has always been the case, investors (private and public) will continuously find new ways to design, interlink, make sense of, and make decisions (albeit more quickly) based on, for instance, public data on consumer needs. We conclude by observing that municipal finance is one of three means indicated by the Habitat III process to implement the New Urban Agenda, and the platform of the portfolio is certainly in line with the new needs of urban financial instruments.

- A portfolio approach for urban investments - 21. July 2016