Why Housing Matters: The Impact of Affordable Housing for People on Low Incomes

Good and affordable housing is key to people’s well-being. Andrew Jones presents the latest research from social enterprise Reall and unpacks what impact it has on the bottom 40 per cent of the income pyramid.

The Covid-19 pandemic has drawn new attention to the vital importance of secure and decent housing, as both a form of shelter and a wider vehicle for economic recovery and increased resilience. However, the global housing challenge remains enormous. Currently, at least 1.2 billion people live in substandard housing, and 300 million new homes will be needed by 2030 to resolve the growing deficit. The majority of this need will be concentrated in Sub-Saharan Africa, South Asia, and Southeast Asia.

To mobilise investment and deliver affordable housing at scale, we not only need commercially viable housing options, but also understand the wider socio-economic impact that homeownership has on the urban poor. This data and information are essential to better understand customers on low incomes, enhance the effectiveness of housing delivery, and catalyse wider stakeholders.

As a market innovator with over 30 years of experience in the global affordable housing sector, Reall incubates and invests in credible housing developer partners, to deliver quality homes that are sold for less than 10,000 US Dollars to occupants in the bottom 40 per cent of the income pyramid. While housing typologies vary by context, all are built to professional standards and equipped with access to clean water, sanitation, and energy. To deepen the evidence base for the developmental impact of housing, we recently completed an ambitious impact evaluation of affordable housing projects by developer partners in India (SSNS), Kenya (NACHU), Nepal (Lumanti), and Pakistan (AMC).

This research project set out to understand what impact moving into new housing has on low-income households. Quantitative and qualitative data were collected through questionnaire surveys of over 1,250 homeowners, as well as extensive focus group discussions, interviews, and project site visits.

Children playing outside SSNS apartment blocks, which houses over 800 families, Mumbai, India. © Reall, 2010

Housing is Key: Improved Quality of Life

In total, Reall surveyed 1,259 low-income homeowners across 15 project locations in India, Kenya, Nepal, and Pakistan. A retrospective baseline was established through homeowners recollecting their previous socio-economic circumstances, and how these have changed since moving into their new homes. This survey measured a total of eleven wellbeing indicators, such as standard of living, health, safety and security, community cohesion, or job satisfaction.

The results showed significant improvements across all eleven wellbeing indicators, demonstrating a better quality of life for the overwhelming majority of households. All homes have decent water and sanitation access and a substantial majority of surveyed homeowners have piped services on the premises. Many homeowners had never previously imagined they could own a permanent home, and the acquisition of an owned asset has opened up new opportunities for a more dignified life.

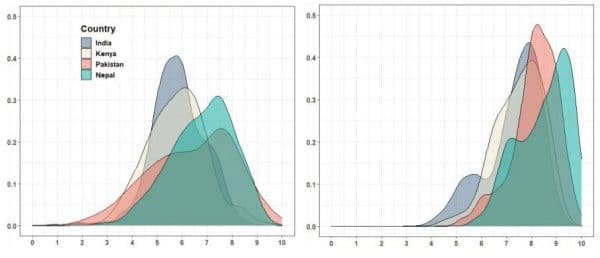

Utilising this data, Reall has produced a mixed quantitative and qualitative ‘Quality of Life Index’ to enable cross-country comparison. In addition to the above wellbeing indicators, this index also includes data on incomes and housing affordability, crowding, access to water and sanitation, and access to school and services.

Figure 1: Reported Quality of Life scores – baseline versus present

As the visuals above illustrate, the reported quality of life of surveyed households increased on average by 21 per cent in Nepal, 23 per cent in Pakistan, 32 per cent in India, and 34 per cent in Kenya. This could be directly attributed to the impact of moving into new affordable housing. This research has also illuminated key learnings to further enhance the quality of life, such as improving community engagement before and after project delivery and focusing more on people’s livelihoods.

Gender Equality

Another major observation was that across all countries and projects, women benefitted the most from affordable housing and experienced the greatest transformation. Women articulated how their new homes had improved the quality of their lives and freed up valuable time to focus on family and business. Improved privacy was a particularly notable benefit, as many women are now free to bathe in the privacy of their own homes and sleep in different rooms from their children.

Many female respondents had also previously taken hours each day to collect water. For these occupants, improved access to water has transformed this situation and hugely liberated them and their time. Safety and security have improved significantly. Those that had previously lived in slums spoke of endemic insecurity, after dark.

Children playing together in the neighbourhood, Nairobi, Kenya. © NACHU, 2019

Housing Affordability

We also asked survey members about housing affordability. A home is considered affordable if a maximum of 40 per cent of household income is spent monthly on housing finance payments. Our research demonstrated that the monthly repayments were affordable for about 80 per cent of homeowners across eleven projects in Kenya, Nepal, and Pakistan; in India, projects were offered at no cost. This proves the capacity of low-income households to repay loans and create an owned asset that radically improves their chances for a better life.

In addition to this quantitative data, focus group discussions revealed that many lower-income earners consider their monthly loan repayment to be ‘affordable’, despite them being five or more times larger than previous rental payments. Indeed, for these clients, the memories of unscrupulous landlords and the prospect of owning a quality housing asset were important drivers not captured in calculations of monthly expenditure.

Key Learnings for the International Affordable Housing Sector

The evidence presented in this article is a powerful argument for affordable housing as a vehicle of major transformation for people living on low incomes, especially women and girls. In addition, this research also illuminates important lessons and areas of improvement for the international housing and urban development sector.

Focus on Livelihoods and Sustainable Communities

Many clients experienced stagnating or even reduced ‘real’ incomes, compared to when they originally moved into Reall housing and the present day. This is primarily due to more challenging global economic conditions for the bottom 40 per cent in the countries and regions under investigation. However, incomes contracted more when clients were relocated to a new area of the city for housing as distance to jobs increased. Thus, affordable housing developments must consider access to jobs and social infrastructure from the outset and foster sustainable communities.

Improve Housing Developer Capacity

Affordable housing developers must improve pre- and post-project engagement. This includes implementing systems to accurately assess the capacity of customers to repay loans (especially informal workers) and ensure qualified homeowners can save sufficient capital to reach their deposit target.

Address Land Scarcity

The price of land is a significant obstacle to housing affordability for poor urban communities and requires innovative solutions to reduce costs. Reall recommends policy and regulatory interventions around official minimum plot sizes, and development for vertical building and densification.

Unlock End-User Financing Solutions

The partners evaluated in this research have advanced innovative solutions for unlocking access to affordable housing finance for their low-income customers. These solutions include leveraging government subsidies (India), utilising community savings and micro-mortgages (Kenya and Nepal), and brokering new commercial bank products (Nepal and Pakistan). To unlock affordable end-user financing at scale, we require patient advocacy, the development of quality products, and further evidence of the viability of the low-income segment to repay loans and acquire quality housing assets.