Why Cities Climate Finance Matters

At the Climate Action Summit, it is widely acknowledged that cities are key in addressing climate change. Yet, sufficient funding for necessary measures is often hard to come by. Barbara Buchner presents some new and promising approaches of mobilising finance for building resilient urban infrastructure.

Not long ago, cities were a marginal topic in the climate finance debate. The trillions in investment needed to limit global temperature rise to 1.5˚C above pre-industrial levels were often focussed on national governments and their National Determined Contributions (NDCs), without addressing urban challenges and opportunities. This is no longer the case.

About 70 per cent of the world’s population will live in cities by 2050, yet only about 25 per cent of the infrastructure needed to satisfy the basic needs of future urban population exists. Rapid urbanisation, which accounts for 80 per cent of global economic output, 66 per cent of global energy demand, and more than 75 per cent of global carbon emissions, highlight the central role of cities in addressing climate change.

However, most cities today don’t have sufficient funding to build the sustainable and resilient infrastructure needed to withstand the impacts of climate change in the coming century. Each year, more than USD 1 trillion is missing for urban investment. The Global Commission on the Economy and Climate suggests that the world will need to invest in roughly USD 93 trillion of low-carbon and climate-resilient infrastructure over the next 15 years.

Traditional Approaches Have Failed

The traditional approaches of mobilising finance for national and sub-national governments have failed to fill the climate finance gap for cities. It is crucial to develop innovative financial and regulatory mechanisms that can accelerate local climate action and prepare ‘bankable’ infrastructure projects which can be funded by private and public financial institutions.

Co-ordinated efforts that bridge the gap between the supply and demand of climate finance can prove instrumental in facilitating innovation and boost investment in sustainable urban infrastructure. The Global Innovation Lab for Climate Finance, of which Climate Policy Initiative is the Secretariat, has explored some promising, transformative instruments for cities climate finance needs over the years.

For example, Pay As You Save for Clean Transport (PAYS) is a vehicle to accelerate investment in clean transit by lowering the upfront cost of electric buses, allowing a utility to capitalise the on-board battery and charging station for bus owners and recover its costs with a predictable monthly charge. Financial analysis indicates strong potential for impact in half a dozen countries on three continents. For example, in Santiago, Chile, a PAYS investment for 100 buses leverages more than 70 dollars of investment capital for each grant dollar, generating USD 25 million in electricity sales revenues, and eliminating 62,000 tons of CO2 emissions.

Another example, the Climate Resilience and Adaptation Finance Tech Transfer Facility (CRAFT), is a fund that blends commercial and catalytic finance to invest growth equity in companies to accelerate the diffusion of climate intelligence products and resilience building solutions.

Cities Climate Finance Leadership Alliance

Given the urgency of climate change, and the potential cities have to reduce its impacts, the need for collaboration in this sector is more important than ever.

That is why we are relaunching the Cities Climate Finance Leadership Alliance (“the Alliance”) with greater political support from Germany. The Alliance is a coalition of leaders committed to deploying finance for city-level climate action at scale by 2030. It is the only multi-level and multi-stakeholder coalition currently existing aimed at closing the investment gap for urban subnational climate projects and infrastructure worldwide.

With Climate Policy Initiative as the new Secretariat, the Alliance will serve as the main platform for cooperation, partnerships, and advocacy in the field of subnational climate finance, aiming to amplify ambition and to bridge demand and supply along the investment chain for city-level climate-related finance. Its members represent many of the world’s major public and private financial institutions, governments, international organisations, NGOs, research groups, and city and subnational networks. As such, its members also represent the main market players in city-level climate finance.

By taking part in the Alliance, and thus contributing expertise, access to networks, and funding, its members have committed to work together to bridge demand and supply for sustainable climate-friendly and resilient finance at the subnational level. In its next phase, Alliance members have specific aims to:

- Build awareness of city finance needs and opportunities

- Craft a strong global architecture to support measurement and evaluation

- Identify existing solutions and gaps in city-level climate-related finance

- Support new investment solutions that fill crucial gaps in cities climate finance

More Efforts

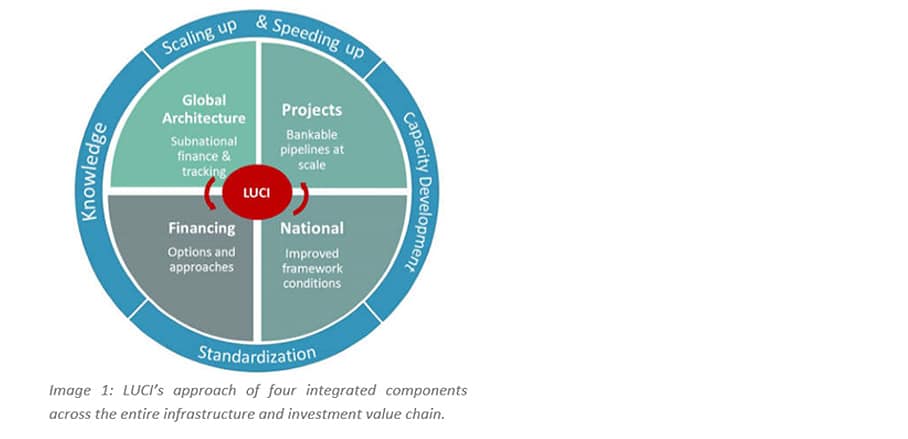

The Alliance is also supporting the Infrastructure, Cities and Local Action (ICLA) Decentralized Finance Subtrack of the 2019 United Nations Secretary-General Climate Change Summit in New York, with the Alliance prepared to become the connective tissue for the Leadership for Urban Climate Investment (LUCI) deliverable. LUCI aims to successfully leverage the comparative advantages and unique capabilities of the members while also providing knowledge management to them.

© Courtesy of Climate Policy Initiative

- Why Cities Climate Finance Matters - 23. September 2019