From Risk Aversion to Climate Resilience: MHT’s Climate Risk Insurance Game

Women are particularly affected by climate change. Chirayu Brahmbhatt introduces an innovative game on climate risk insurance for female empowerment.

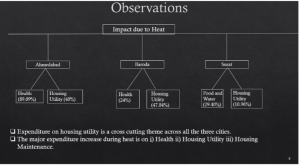

Climate Change has led to an increase in the daily peak temperatures. In recent years, heat wave events have become more frequent, intense, and longer causing a great deal of problems to citizens.

The impact of such heat wave hazards is exacerbated by rapid urbanisation, which means many communities in cities live in vulnerable conditions. However, the impact of such heat wave events is also disproportionate. The poor and the vulnerable communities bear the most burden of such events due to their vulnerable socio-economic status while contributing the least to such changes. Most of these residents are engaged in informal occupations like construction work or street vending, which is characterised by low wages, informal incomes, and a lack of a social security net to protect them from climate and other risks.

Climate and Gender

This particularly affects women, who bear the dual burden of income generation and managing household responsibilities while their access to education and financial resources is overlooked as compared to their male counterparts. Apart from the health hazards during the summer months which lead to loss of workdays and increased expenditure on medical needs, most families spend more on their general needs such as transportation, food, and electricity to increase thermal comfort, even if they aren’t securing any work.

Application of solar-reflective paint © MHT

The Mahila Housing Trust (MHT) is a grassroots development organisation founded in 1994 and aims to improve urban built environments in poor communities through collective action. MHT’s work on climate change and gender began in 2015 when it entered the Global Resilience Partnership. Its principal focus lay on four climate change-induced stresses: excess heat, excess rain, water scarcity, and vector-borne diseases.

In 2021, MHT embarked on a journey to introduce climate risk insurance for the members of its credit cooperatives in the three cities of Gujarat-Ahmedabad, Baroda, and Surat. MHT‘s credit cooperatives are credit institutions offering savings and credit services, that are owned and controlled by its members – women from urban slums. The insurance is essentially a meso-level product based on parametric insurance, which aims to cover the risk of loss in income during extreme heat wave events, where a payout is triggered when a threshold temperature is breached. This means, that unlike regular insurance, it doesn’t pay for the actual losses you had. Instead, it pays a set amount right away.

Women are severely impacted during excess heat events in summer. Most home-based workers would work less to increase their thermal comfort, which leads to a lower income generation.

Gud Luck – the Climate Risk Insurance Game

To tackle this issue, MHT developed Gud Luck, a climate risk insurance game specially designed to introduce the concepts of climate risks – excessive heat and rain – as well as climate risk insurance to women from poor urban communities.

The game canvas and various other assets of GudLuck © MHT

“How much money have you saved?”

After counting the bills, Ushaben exclaimed: ‘I have INR 8,000 ($ 96.47).”

“You learned about heat risks and their impact on your earnings and expenditure, would you like to invest the savings in a cool roof technology or climate risk insurance?”

Ushaben in Orange Saree, second from left © MHT

“I have never seen so much money at once in my life. I will bear the extra heat during summer. So what if I fall ill? I am not new to it. So what if I lose a few days’ work? I have saved enough money to get me through the summer.

I don’t know how much benefit I will get from a cool roof and anyway, I don’t understand climate risk insurance.”

This brief conversation between the MHT team and Ushaben took place during the first game of Gud Luck. One of the striking features of the conversation with Ushaben was the negative risk perception women carry towards extreme weather events caused by climate change. From a risk or impact standpoint, these communities bear the largest brunt due to climate change because of their low adaptive capacities, given their lower socio-economic status.

Risk Aversion Points to a Larger Story

Though extreme weather events have only increased in duration, frequency, and intensity in recent years, this risk-averse perception of climate change and its impacts points to a larger story. A story referring to a lack of education, lack of access to inclusive and affordable financial products such as climate and disaster risk finance and insurance solutions (CDRFI), gender gap, and socio-economic marginalisation.

Slide highlighting major findings, after KPI’s were carried in 100 houses for CRI © MHT

So, when MHT developed Gud Luck, they kept in mind that the concept of parametric insurance and any form of insurance is new to home-based female workers; hence, they need to be educated about it. Moreover, women do realise that the temperatures have been soaring in recent years. They attribute it to urbanisation and afforestation but still don’t connect it with climate change. For them, it is an “act of god.” In addition, they are willing to invest in such insurance, provided the premiums are affordable.

The “How”, “What,” and “Why” of Climate Risk Insurance

Hence, Gud Luck simulates the introduction of parametric insurance during excess heat wave events. The game introduces climate-resilient housing technologies and climate risk insurance. It further demonstrates how those who have invested in climate-resilient technologies and CRI fare better financially in dealing with climate stresses than those who simply saved cash or invested in gold.

While savings are the cheapest financial means for risk absorption, they are not always assured. To tackle the problem of educating women on parametric insurance and climate change, the game is preceded by a two-day training, which focuses on imparting knowledge about the “how”, “what”, and “why” of parametric insurance and its usefulness due to climate change. This is done through various interactive mediums such as videos, board games, and card games.

The training and gameplay are simple yet powerful tools to communicate the idea of climate risks and assert the need for a risk transfer solution such as climate risk insurance (parametric insurance) to make vulnerable communities more climate resilient. The heat risk insurance will be established in next year’s heat season. As women like to invest in familiar financial products, MHT’s goal is to increase poor women’s familiarity with risk reduction measures and risk transfer solutions such as climate risk insurance.

- From Risk Aversion to Climate Resilience: MHT’s Climate Risk Insurance Game - 10. October 2023