Understanding and Tracking Affordable Housing Investment Opportunities in Africa

Housing has become a policy issue that interests not only housing departments and local construction authorities, but Central Banks and financial players as well. Kecia Rust from the Centre for Affordable Housing Finance in Africa (CAHF) explains why housing has become an investment opportunity, and the role that policy makers play.

Cities are complex systems, and across Africa, are growing at a rapid rate unprecedented in urban history. While the scale and pressure of urbanisation is overwhelming, this agglomeration of activity offers an incredible opportunity for development. At the same time, the confluence of efforts to promote financial inclusion, urban development, infrastructure investment, and macro-economic policy attention create a uniquely enabling environment for the growth of housing in particular. As government, the private sector, and households and communities themselves find their places in the housing ecosystem, innovation is being found along each link in the housing value chain.

Lenders, investors, builders, and suppliers are getting much better at identifying and targeting niche markets. If not yet a move away from the attraction of large-scale, massive developments, we can see increasing attention towards the notion of “massive small”: the opportunity to be found in the connected results of many small projects and initiatives at the local level that together add up to something big. [1]“Massive Small” is an idea promoted by Kelvin Campbell, an architect and urban designer based in London, UK. The Massive Small Collective “believes that incremental bottom-up initiative supported by an enabling top-down policy and intervention provides our best chance at creating thriving cities.” See https://www.massivesmall.org (Accessed 13 Oct 2018)

Housing as an Investment Opportunity

From a recognition of backyard rental and inner city refurbishment as viable housing supply streams, to the development of underwriting standards for borrowers in the informal economy, to the financing of incremental housing construction at scale, to the use of blockchain technology to improve titling efficiencies, innovation along the value chain and at the local level is making headway and creating precedent that is bankable.

Governments are increasingly becoming aware of the opportunity to be found in private sector interest. The impact of housing on the economy – on macroeconomic growth and job creation, as well as on the potential for financial intermediation and the ongoing sustainability of cities – is as significant as the very clear need to address the poor housing and slum conditions that persist for the majority of urban residents.

In Kenya, housing has become part of the current President’s “Big Four” plan for his term of office. President Kenyatta has committed to increasing housing supply, with a promise of 500 000 affordable housing units by 2022. To achieve this, government departments are actively engaging in policy and fiscal reform in support of more effective and affordable housing delivery. Their efforts are mirrored in the private sector, where the Kenya Property Developers Association has set up an Affordable Housing Task Force to compile its members’ advocacy positions for government. [2]Centre for Affordable Housing Finance in Africa, CAHF (2018). Yearbook: Kenya profile.

These efforts will no doubt streamline Kenya’s housing delivery value chain and improve the prospects for affordable housing delivery. At the same time, they provide hope that spreads beyond Kenya’s borders: that affordable housing is a possibility – a viable investment opportunity. Similar attention is being given to housing by governments in South Africa, Tanzania, Ethiopia, Nigeria, Côte d’Ivoire – indeed, in very many governments, housing is becoming a subject of attention not just by the housing department, but by the Central Bank.

Opportunities for Policy Makers to Direct Investor Attention

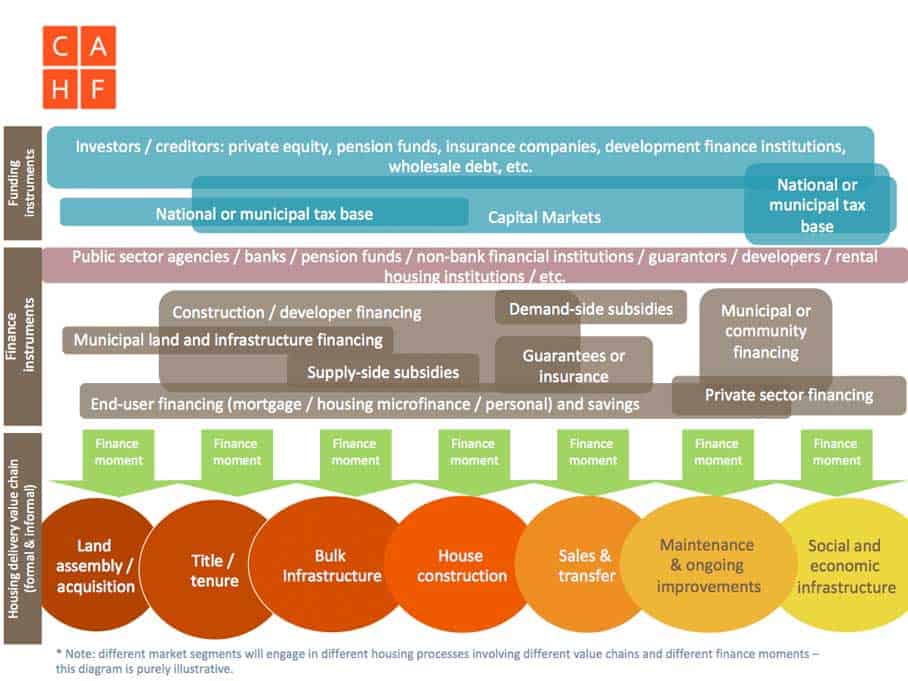

Investors have been watching the emerging innovation, noting this moment of political and policy will, and responding with efforts of their own to maximise the opportunities as they emerge. The housing value chain intersects with the housing financing chain on the basis of market certainty – as innovation appears in each link along the chain, investors look for ways to leverage that success in terms of their own strategies up the financing chain.

Policy-makers can direct investor attention to specific niches by creating certainty in the policy and economic context, and by taking steps to highlight and publicise those opportunities.

Source: Centre for Affordable Housing Finance in Africa, 2018

The Centre for Affordable Housing Finance in Africa (CAHF) has found that in the past ten years, the top twenty investments committed to housing in the Southern African Development Community (SADC) region by development finance institutions, government, private sector investors and pension funds totalled US$ 7.9 billion. Development Finance Institutions (DFIs) play an important role in facilitating these investments into the markets: the largest investor by far has been the African Development Bank, with a 16 percent share of the total invested.[3]Wood, D (2018). The Housing Investment Landscape in the Southern African Development Community. www.housingfinanceafrica.org (forthcoming). See all the Housing Investment Landscape reports here: http://housingfinanceafrica.org/projects/landscapes-housing-investment-africa/

Beyond that, however, the diversity of investors is interesting. Government employee pension funds have been increasing their participation, and while international investors (notably the Chinese, but also European) are prevalent, there has also been a growing number of private sector local investors, suggesting a domestic appetite for housing investments.

Investments in the SADC region are primarily equity (40 per cent) and debt (60 per cent). The top equity investment focus (36 per cent of all equity investments in housing in the SADC region) is housing construction, followed by housing microlending (30 per cent), housing finance (23 per cent) and support for the financial sector (11 per cent).

The majority of debt allocations are for housing microlending (35 per cent), followed by support for the financial sector (20 per cent), housing construction (16 per cent), housing finance (15 per cent), infrastructure (12 per cent), and slum upgrading (2 per cent). Technical assistance allocations focus on slum upgrading (49 per cent), building housing (32 percent) and policy development (15 percent).

Data is the Key to Assess Risks and Uncertainties

It is all still rather opaque, however. CAHF has worked hard to extract housing investment data from the portfolios of investors – banks, microfinance institutions, pension funds, private equity investors, DFIs, governments, and so on – and for the SADC region has identified 327 separate investments.

We are also currently working on a similar tracker for North and West Africa, and for East and Central Africa. The data is drawn from annual reports, websites, interviews, and news reports; there is no single source. This has the effect of each investment being a singular event. Without the benefit of trends analysis, investors’ ability to understand and quantify risk is therefore undermined, and return expectations get amplified to accommodate the uncertainty.

Perhaps the most critical intervention that governments, as well as DFIs, can make in support of greater investment in affordable housing, therefore, is in data. Governments can use their regulatory function to require focused reporting on loan origination, performance and impact; on investment targets, use of funds and investment performance; on market performance of housing once delivered, and so on. In Kenya and Tanzania, the Central Bank regularly reports on mortgage market development.4text This should be a standard practice of all Central Banks and a key part of their regulatory function.

Factors for Success

Capital markets authorities should similarly report on the progress of investments in residential real estate, segmenting by target market, to assist investors in making their decisions. DFIs and other impact investors who seek to promote the development of the affordable housing sector should explicitly track the progress of their investments, and use their investments to insist on transparency so that the key fundamentals are well-known and understood in the investment community.

Supply-side tracking is also important: the nature and progress of incremental housing construction, the size and structure of the rental market, the structure and performance of public private partnerships, and so on. This will be a primary effort of CAHF as we move forward into the next phase of our work.

Innovation along the housing value chain is clearly evident, expressed in local niche markets and across the continent. We can leverage this experience and replicate it in other contexts if we track it, creating baseline information that highlights new opportunities for the investor interest that is clearly there. This is a job for the entire housing sector.

This article is excerpted from the Housing Finance in Africa (2018) Yearbook, a publication of the Centre for Affordable Housing Finance in Africa. See http://housingfinanceafrica.org/resources/yearbook/