Offering Affordable Housing in Egypt Through Microfinance

Access to housing finance is an enormous challenge in Egyptian cities. Raed Fares and Safa Ashoub portray the approach by Habitat for Humanity Egypt: a microfinancing programme that also offers technical assistance and ensures to include local communities.

In Cairo, one of the largest capital cities in the world, obtaining affordable housing is quite challenging. In 2020, Cairo ranked seventh among the world’s capitals in terms of population, which is nearly 21 million people. Cairo has a population density of almost 50 thousand people per square kilometre. Due to internal migration, labour opportunities, and higher living standards than other cities, Cairo ranks first among the governorates of the Arab Republic of Egypt in terms of population, accounting for more than 25 per cent of Egypt’s population.

The population growth rate in Egypt also remains high. The Egyptian Central Agency for Public Mobilization and Statistics (CAPMAS) estimates it at 2 per cent annually, which results in the need to provide more than 500,000 units available for housing annually. This requires financing opportunities for housing purposes that meet the needs of all segments of society.

What Options for Housing Finance Are Available to Egypt’s Citizens?

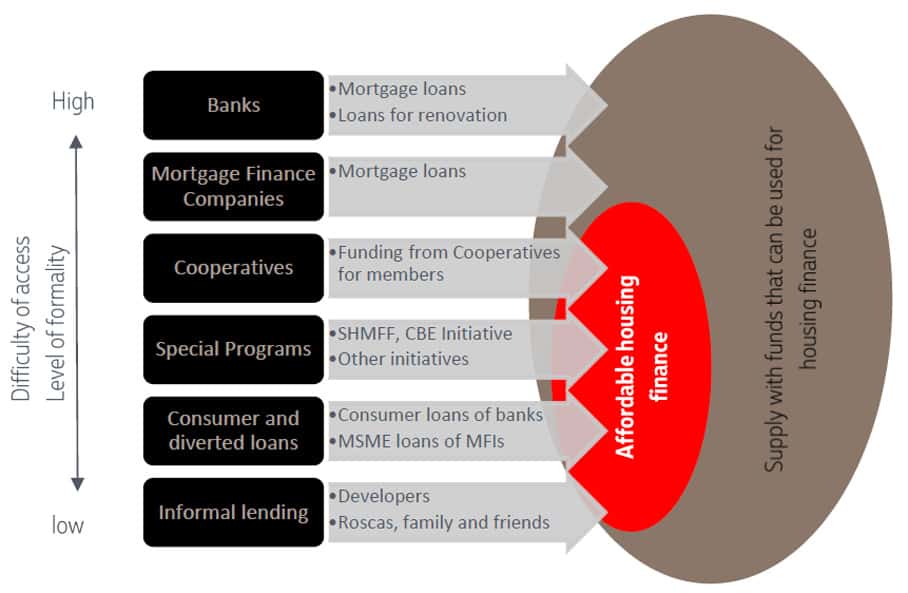

Access to adequate financing is one of the main problems citizens face, especially marginalised and low-income groups. As many citizens do not have any types of bank accounts or are unable to meet the formal lending requirements – especially in housing financing – affordable housing remains a huge problem facing Egypt in general and Cairo in particular.

A Housing Market Study in Egypt that Habitat commissioned in 2021 found that despite the diversity of funding sources available for housing in the Egyptian market, these sources differ in terms of accessibility and cost. For example, banks provide housing financing products at a reasonable cost, but are difficult to access due to legal requirements; sometimes the amount of funding is insufficient. Informal sources also exist, but they are deemed to be of high cost and of short duration, for example, local building developers who offer loans for higher interest rates, which harm the borrowers. Or families obtain financing for economic purposes from microfinance institutions and then divert it for housing, risking their own ability to pay back their interests.

© Habitat for Humanity Egypt

The Habitat Egypt Model: Microfinance Meets Community

Given the gap between the needs and the resources available here, Habitat for Humanity Egypt – a branch of Habitat International – played a leading and pioneer role in creating an appropriate housing programme for marginalised and most-in-need groups. The core idea was to provide affordable financing opportunities in partnership with Egyptian society. The programme is based on designing a microfinance model for housing purposes that can be accessed by the lowest-income and marginalised groups so they can improve or build an adequate house for them at a reasonable cost.

To achieve its purpose, Habitat Egypt collaborates with national NGOs as local, community-based partner organisations, and local committees in selected communities. Habitat Egypt does not disburse loans directly to beneficiaries. Rather, it provides loan capital to the NGO partners exclusively for housing microloans, specifically to assist poor and low-income households in selected communities. In turn, the NGO partners assist and supervise local, community-based organisations (CBOs) and loan committees, who disburse and manage these housing microloans. Habitat Egypt provides training and technical support to the NGO staff responsible for these loans, and the participating CBOs and loan committee members in each community.

More Than Just Housing Finance

From its inception in 1989 until now, Habitat Egypt has helped more than 45,000 low-income families in rural and urban areas in upper Egypt and Greater Cairo to improve their housing quality by providing access to affordable housing finance.

In the fiscal year 2020 (FY20), Habitat Egypt provided 2,676 micro-loans of 34.7 million Egyptian pounds through its partners. 70 per cent of the loans have been used for home improvement finishes, 25 per cent for building roofs, and other improvements have accounted for 5 per cent. Regarding the target group, most families’ average income is 2,000 EGP monthly, which is equivalent to 110 USD.

Habitat Egypt provides not only access to finance, but also offers free technical services to the borrowers. Experienced and trained engineers assist the CBOs and loan applicants with the specification of construction requirements, preparation of engineering designs (if needed), estimation of actual costs for planned home renovations and new construction, and inspection of the completed works.

The benefits of these engineering services are considerable. First, they ensure that the estimated cost is sufficient to complete the planned renovation or construction. Therefore, the loan for a completed home project is much more likely to be repaid on time and in full. Second, this ensures that the renovation or construction is properly planned and designed and, if executed properly, will be a sound construction and successful project. Third, it provides greater assurance to the CBO loans committee that the proposed loan will be used for home improvement and not diverted to another use.

Habitat Egypt supports the NGOs and CBOs to be sustainable and self-sufficient through building their capacity to plan and manage the microloans programme for housing, thereby continuing and expanding its mission. Habitat Egypt also focuses on how to raise awareness among all beneficiaries and partners on how important adequate housing is for a healthier and more stable life. It also works to promote the volunteerism concept through mobilising volunteers and organising work camps for youth, encouraging knowledge exchange and a better understanding of the importance of community volunteer work.

How Would a Legal Framework Support Habitat Egypt’s Microfinance Programme?

One of the challenges facing this model is the lack of a legal framework regulating microloans for housing purposes for people with low incomes who are unable to prove their income. The existence of legislation would create both a market and opportunities for investors to enter this market, thereby creating a sufficient supply to meet the increased demand and expansion. In other words, establishing an adequate legal and regulatory framework would help to include other actors in the model and help address the gap in housing provision at the grassroots level.

What Opportunities Are Yet to Be Tapped?

So far, Habitat Egypt has been operating under the Ministry of Social Solidarity as a registered foreign international organisation. However, Habitat Egypt believes that its key stakeholders are the Ministries of Finance and Housing as well as the Ministry of Local Development and is keen on developing the sectoral cooperation with these entities further in order to tap on the opportunities that are falling beyond the current institutional set-up. By developing these connections, Habitat Egypt can share its expertise in the area of Housing Microfinance and can work together to establish similar programmes at the municipal levels in a way to ensure the access of the ultra-poor to this facility. This could contribute to establishing mechanisms for financial inclusion especially to target remote and vulnerable areas as well as foster the integration of such vulnerable communities into sustainable development processes on a national scale, ensuring that no one falls behind.